Industrial washing / Articles

Capex: what is it and how to choose between buying or renting

Discover practical ways Capex keeps operations reliable and efficient, and make sure your investments count.

8 minutes of reading

8 minutes of reading

2025-11-21 09:32:40

Capex, or Capital Expenditure, represents long-term investments. Increasing it is often a sign of confidence – especially if what you’re buying takes years to payoff. Missteps, however, can be deadly: the wrong machine, an untimely purchase, or poor planning can tie up cash, create maintenance headaches, or leave assets underutilised.

In this article, we break down Capex in practical terms, showing you how to measure, optimise, and make smarter investment decisions, so every euro you spend works harder and lasts longer.

What Is Capex?

Capex (Capital Expenditure) covers investments in assets that deliver value over multiple years, like machinery, buildings, major equipment upgrades, or large-scale software development. Where Opex pays for running the business day-to-day, Capex buys the capacity, capability or efficiency that will serve the company in the medium to long term.

Capex decisions are strategic: they affect production capability, long-term costs, balance sheet structure and tax treatment. A good Capex choice increases throughput, lowers unit costs or enables new products; a poor one ties up cash in obsolete kit.

Why Capex matters

Here’s why Capex matters and what makes it such a powerful strategic lever.

1. It builds the foundation for long-term growth

You can’t scale sustainably without the right infrastructure. Investing in equipment, technology, or facilities creates the physical and digital backbone that supports future expansion. It’s what allows production to increase without costs spiralling or quality slipping.

2. It strengthens independence and control

When you own your critical assets, you’re not tied to someone else’s timelines, pricing changes, or contract renewals. You control maintenance schedules, production planning, and system upgrades according to your needs, not a supplier’s. And that control translates into agility. You decide when to push harder, when to pause, and how to adapt to shifting demand without renegotiating every time.

3. It enhances financial stability

Although Capex requires higher upfront investment, it also provides predictable long-term cost structures. Once an asset is paid for, it often delivers value for years with relatively stable running costs. That makes budgeting easier and shields your operation from the volatility of recurring rental or subscription fees.

From an accounting point of view, Capex also builds asset value on the balance sheet and offers depreciation benefits, helping to smooth taxable income over time.

How to improve Capex

Here’s how to turn your capital expenditure into a real strategic advantage.

1. Connect every investment to business goals

Capex should serve a purpose beyond replacing old equipment. Define clear objectives for each proposal, like capacity increase, quality improvement or energy savings. Require tangible ROI or payback indicators and make alignment with strategic priorities a condition for approval.

2. Adopt lifecycle thinking

Low purchase price doesn’t always mean low cost. Evaluate investments based on their total impact over time. Calculate the Total Cost of Ownership (TCO), including energy, maintenance, training, and end-of-life costs. Consider durability and ease of maintenance when selecting equipment.

3. Use data to guide timing and priorities

Timing can make or break a Capex decision. Track utilisation rates, downtime, and repair frequency to identify assets creating recurring Opex spikes. Ideally, replace or upgrade before failures, not after.

4. Standardise evaluation and approval

Consistency is key to fair, transparent decisions. Create one framework that applies to all proposals. Score projects by strategic fit, financial return, operational impact, and regulatory compliance, compare competing proposals objectively, and keep documentation centralised and accessible.

5. Improve forecasting and cash flow visibility

Capex and liquidity are tightly connected. Integrate Capex plans into long-term financial models, simulate different economic or supply chain scenarios and review commitments regularly to prevent overextension.

6. Leverage technology for better control

Digital tools make Capex management faster, more transparent, and more accurate. Use ERP or project dashboards to track spending and progress, set alerts for cost overruns or delays and apply AI-based analytics to predict risks and optimise future budgets.

7. Review post-investment performance

Approving the project is only half the job. Learning from it is the other half. Compare actual results with projected ROI and payback, monitor maintenance and operational outcomes post-implementation and document lessons learned to refine future investment criteria.

Capex vs Opex: how to choose when planning your next purchase

When making major financial decisions, one question tends to surface early: should you invest in ownership (Capex) or rent (Opex)?

Both models have clear advantages. The key is knowing which aligns best with your company’s goals, resources, and growth strategy.

Capex: building long-term value

Capex (Capital Expenditure) refers to investing in assets that will serve your business for years, such as equipment, vehicles, production lines, or even new facilities. It’s a long-term commitment that prioritises ownership and control over flexibility.

Pros:

- Builds tangible value into your company’s balance sheet.

- Once paid off, the asset continues to generate value with minimal recurring costs.

- Offers full control over usage, maintenance, and upgrades.

Cons:

- Requires significant upfront investment, which can strain cash flow.

- Assets may depreciate or become technologically outdated.

- Less adaptable if production needs or market conditions change.

Opex: maintaining agility

Opex (Operating Expenditure) covers ongoing expenses for leasing, renting, or subscribing to services. Instead of owning the asset, your business pays for usage, gaining agility and predictable costs.

Pros:

- Lower initial investment and simpler budgeting.

- Easier to scale operations up or down as demand fluctuates.

- Maintenance and upgrades are often included in the service.

Cons:

- No ownership or residual value at the end of the contract.

- Long-term costs may exceed the price of ownership.

- Dependence on external suppliers or contracts.

How to choose wisely

If your business thrives on long-term stability, ROI, and complete control over key assets, Capex can be the strategic choice. But if adaptability, fast scalability, and financial flexibility are top priorities, Opex might offer more breathing room.

For many companies, the smartest approach is a hybrid one, meaning investing in critical infrastructure through Capex, while using Opex for services that evolve rapidly or demand constant innovation.

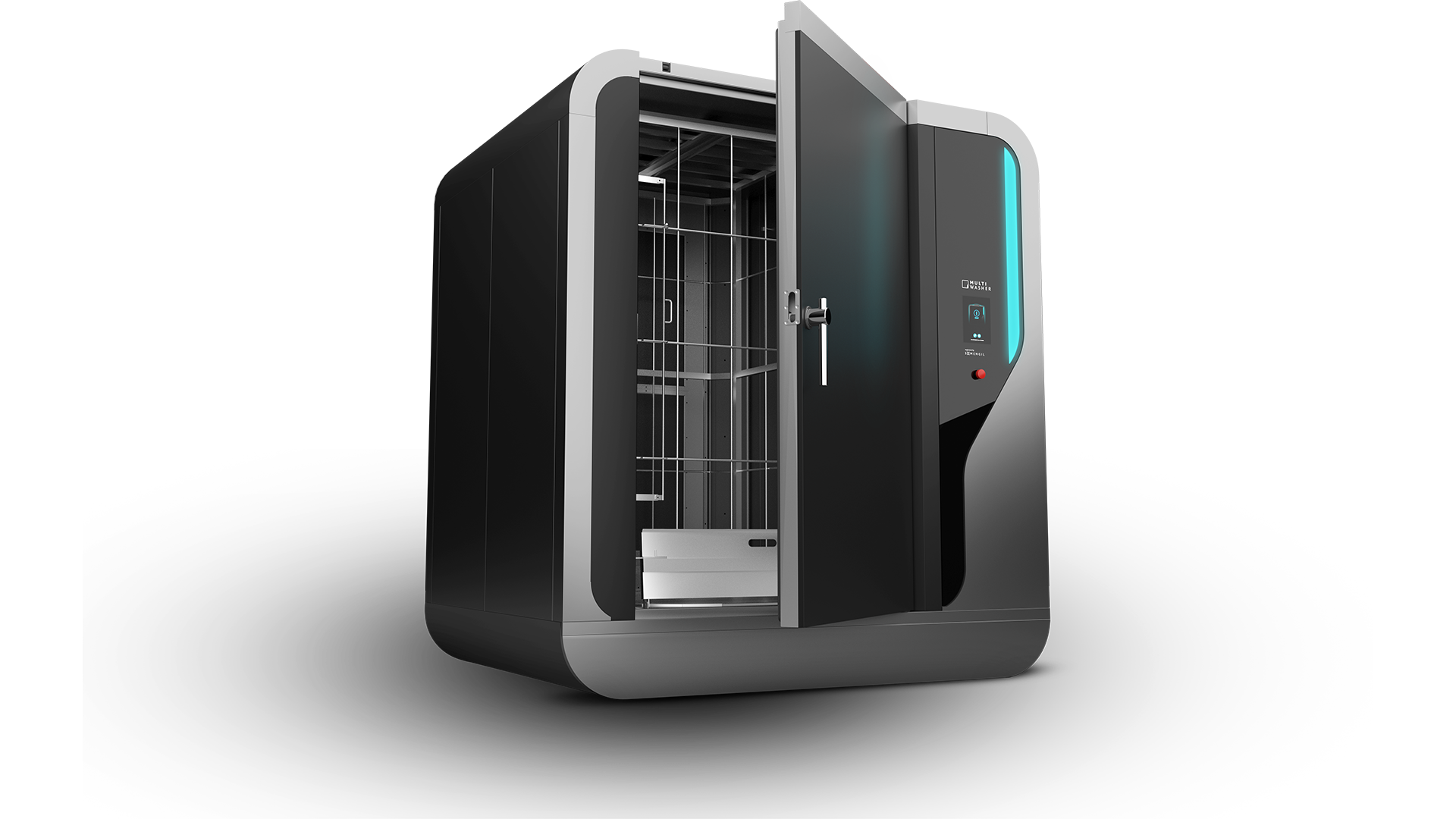

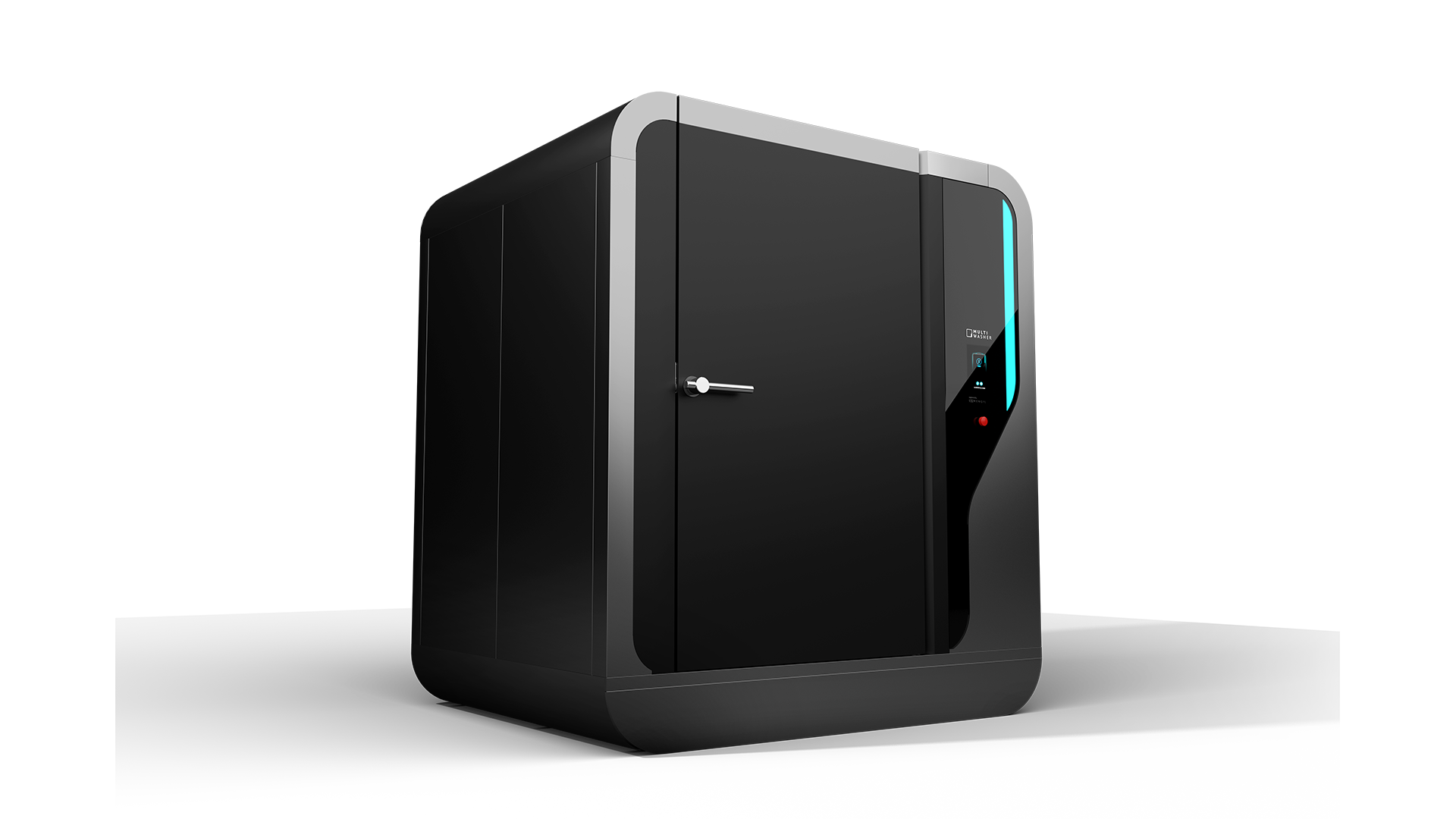

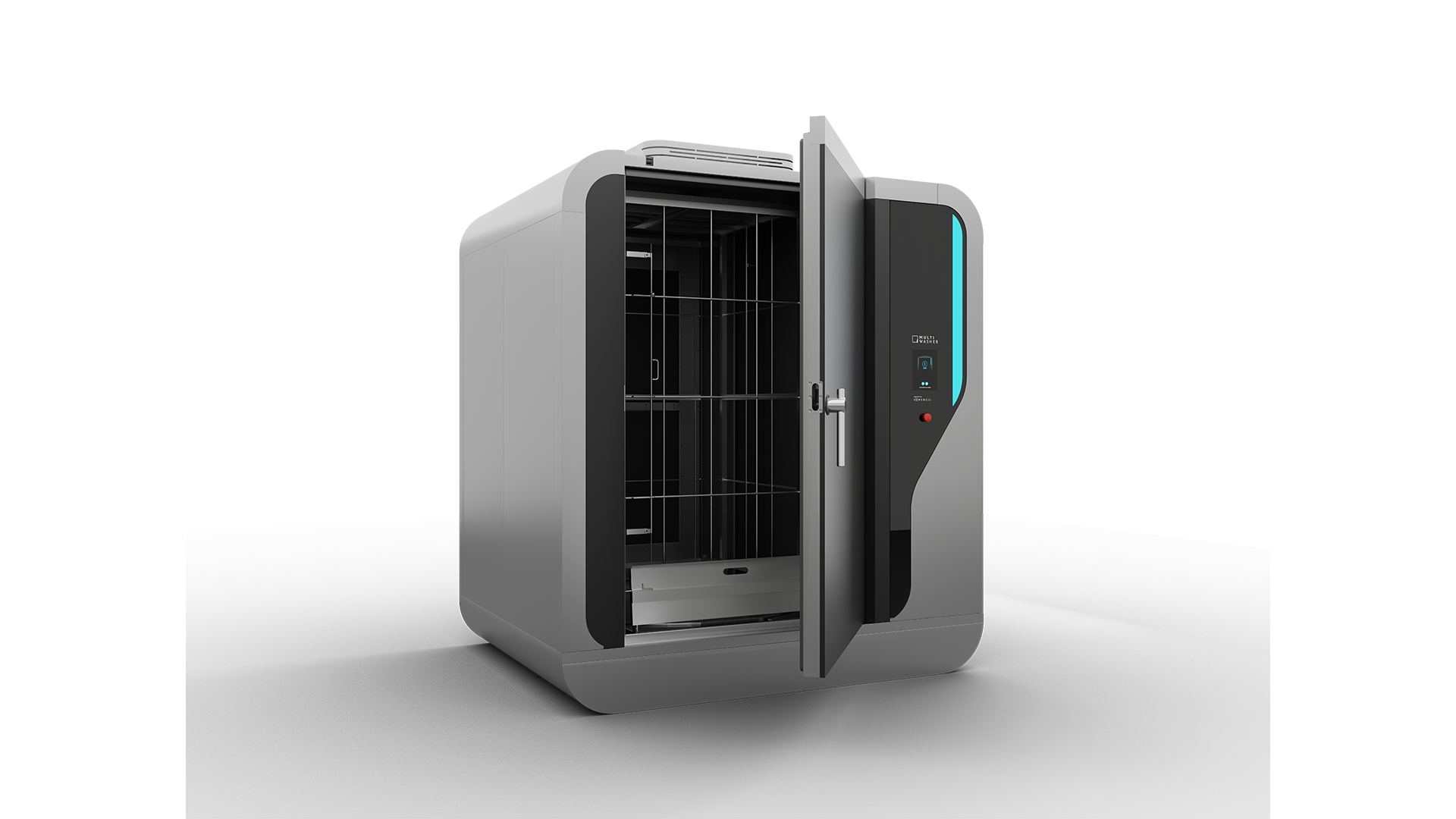

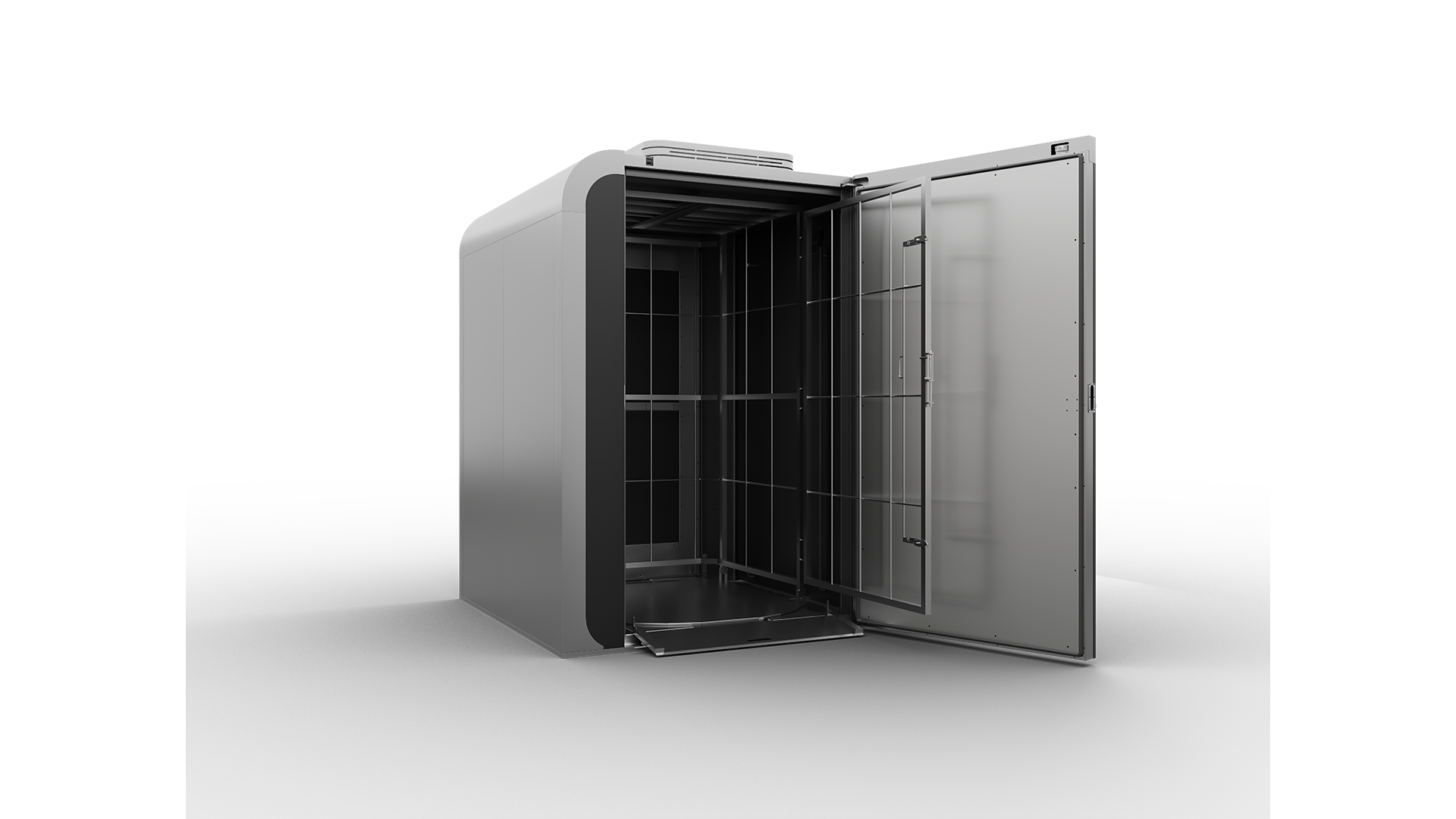

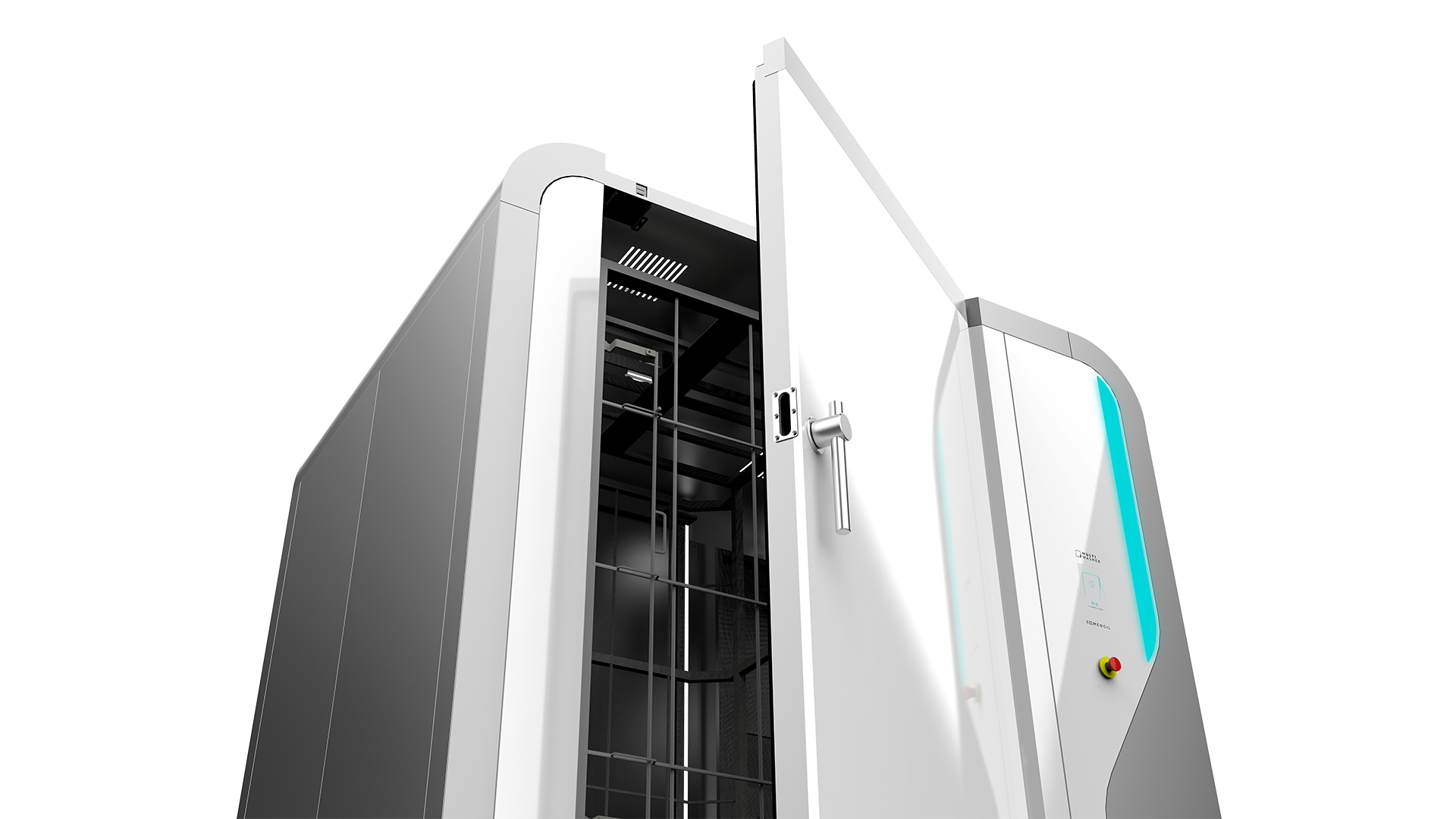

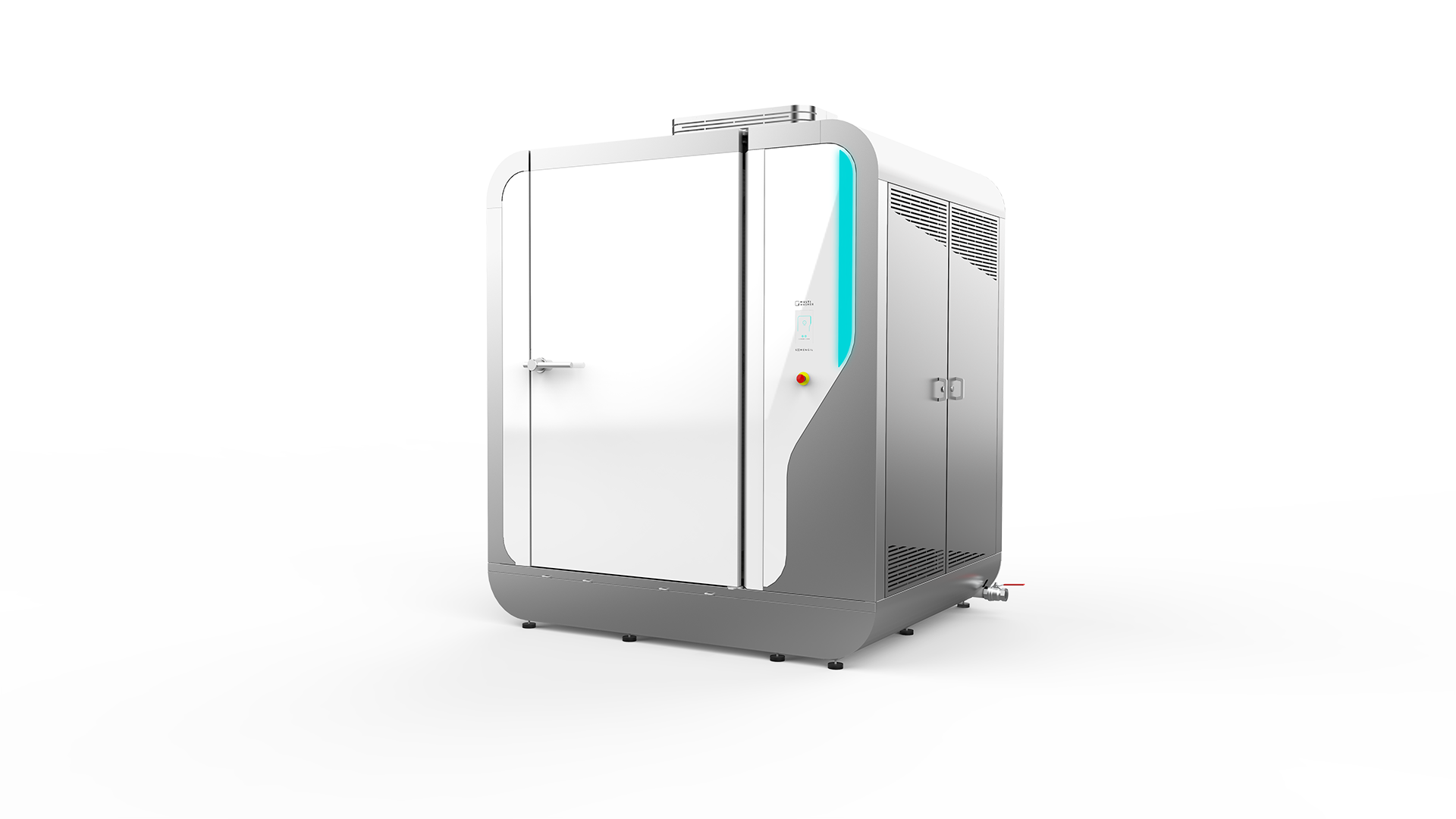

Why Capex makes MultiWasher a smart investment

In industries where hygiene and efficiency define competitiveness, increasing Capex is a strategic decision.

But when it comes to industrial washing systems, you can choose your purchase model. The MultiWasher is a state of the art washing equipment, built from premium materials and engineered for high-volume industrial use. You can choose to buy it (impacting Capex), or rent it for a montly fee (Opex). It’s entirely up to you.

Get in touch to see how it can make a real difference in your daily workflow.

You may also like

Industrial washing / Articles

How to choose washing solutions for logistics companies

Find out how to choose the most innovative and effective washing solutions for logistics companies.

Posted in 2024-01-03

Industrial washing / Articles

Pharmaceutical industry: how to choose the right industrial washing solution

In the pharmaceutical industry, industrial washing is a critical success factor. Find out how to choose the right equipment.

Posted in 2024-03-08

Portugal

Portugal United Kingdom

United Kingdom United States

United States France

France Spain

Spain Germany

Germany Romania

Romania Italy

Italy Czech Republic

Czech Republic Finland

Finland Hungary

Hungary Slovakia

Slovakia Greece

Greece Lithuania

Lithuania South Korea

South Korea Russia

Russia Saudi Arabia

Saudi Arabia Poland

Poland Brasil

Brasil Hebrew

Hebrew